How irs.gov Get Unbelievable Success With Landing Page

As we known,Landing page is an essential part of marketing campaign because it has the unique ability to convert a stranger into a qualified lead. But how can we increase the ROI? How to find landing page copy and image for inspiration? How to know competitors’ advertising strategy?

Fortunately, LandingSpy can help you successfully solve the problems above. LandingSpy is the best landing page software. It tracks the irs.gov ads, and analyzes the landing page data of the ads. Its landing page link is irs.gov.

So, how irs.gov get unbelievable success with landing page?

1.irs.gov’s ad landing page basic information

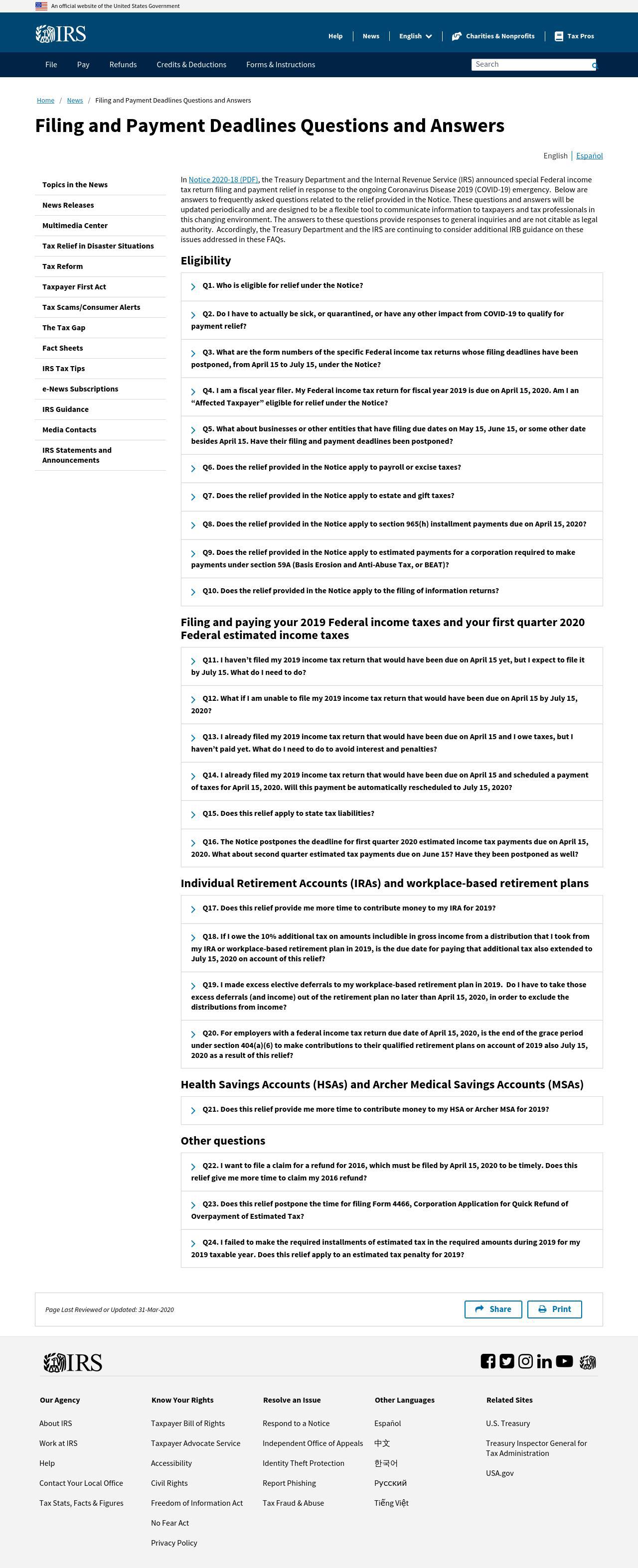

Landing Page Images:

Title:Filing and Payment Deadlines Questions and Answers | Internal Revenue Service

Description:In Notice 2020-18 (PDF), the Treasury Department and the Internal Revenue Service (IRS) announced special Federal income tax return filing and payment relief in response to the ongoing Coronavirus Disease 2019 (COVID-19) emergency. Below are answers to f

Advertising Platform:Facebook

Period:3

Start Time and End Time:2020-04-01~2020-04-04

Landing Type:Other

Language & Countries:N/A&N/A

Related Landing Pages:3

Final URL:irs.gov

The Number of Outgoings Link :0

2. Free related landing pages analytics

In addition to the above ad landing pages, irs.gov recently launched related landing pages with a total number of 3. The main advertising platforms of these related ad landing pages are Facebook、Facebook etc. These ad landing pages include some AB-tested pages. After the final verification, irs.gov has placed a lot of ads by using the most effective ad landing pages.

LandingSpy performed basic data analysis on these related landing pages and selected the top 3 that performed best.

| 1st | 2nd | 3rd | |

| Title | IRS confirms tax filing season to begin January 28 | Internal Revenue Service | Coronavirus Tax Relief and Economic Impact Payments | Internal Revenue Service | Filing and Payment Deadlines Questions and Answers | Internal Revenue Service |

| Description | IR-2019-01, January 7, 2019 — Despite the government shutdown, the Internal Revenue Service today confirmed that it will process tax returns beginning January 28, 2019 and provide refunds to taxpayers as scheduled. | We are offering help for taxpayers, businesses, tax-exempt organizations and others – including health plans – affected by coronavirus (COVID-19). | In Notice 2020-18 (PDF), the Treasury Department and the Internal Revenue Service (IRS) announced special Federal income tax return filing and payment relief in response to the ongoing Coronavirus Disease 2019 (COVID-19) emergency. Below are answers to f |

| Advertising Platform | |||

| Period | 560 | 46 | 3 |

| Start Time and End Time | 2018-11-07~2020-05-20 | 2020-03-30~2020-05-15 | 2020-04-01~2020-04-04 |

| Language & Countries | N/A&N/A | N/A&N/A | N/A&N/A |

The above is the detailed information of the 3 landing pages that advertisers irs.gov have performed best in the recent past. After many A/B tests, these ad landing pages proved to be the most effective. So what do they have in common? By comprehensively analyzing the various data of these landing pages, we can summarize some rules to discover the secrets of high-converting ad landing pages.

1) Title analysis

- The number of words in the title is usually 5-10 words, and the words are as simple as possible.

- Core keywords and important content are put forward.

- Declarative Affirmative Sentences

- Titles with numbers are 36% more likely to be clicked by users than without numbers.

In fact, I prefer the title “IRS confirms tax filing season to begin January 28 | Internal Revenue Service” better than “Coronavirus Tax Relief and Economic Impact Payments | Internal Revenue Service”.

2) Description analysis

Copywriting tests the ability of the writer to perceive the user’s psychology. What we need to do is to stand in the user’s perspective, understand the needs of the users, and introduce your products from what they want to know.

Obviously, the descriptions of these related landing pages all conform to the above rules. For example:

- IR-2019-01, January 7, 2019 — Despite the government shutdown, the Internal Revenue Service today confirmed that it will process tax returns beginning January 28, 2019 and provide refunds to taxpayers as scheduled.

- We are offering help for taxpayers, businesses, tax-exempt organizations and others – including health plans – affected by coronavirus (COVID-19).

- In Notice 2020-18 (PDF), the Treasury Department and the Internal Revenue Service (IRS) announced special Federal income tax return filing and payment relief in response to the ongoing Coronavirus Disease 2019 (COVID-19) emergency. Below are answers to f

If you want to know the description of other landing pages with the best performance in the past 90 days, you can use LandingSpy (landingspy.com) to filter and query.

3) Advertising platform

From the above table, we can see that the advertiser irs.gov’s recent platform for advertising is mainly Facebook.

4) Advertising schedule

Advertisers irs.gov have recently advertised at 2018-11-07~2020-05-20、2020-03-30~2020-05-15、2020-04-01~2020-04-04. The periods the ads continue to run are 560 days, 46 days, and 3 days.

Different industries and different platforms have different effective times when advertising. When scheduling ads, we should check the competitors’ advertising strategies in advance, not only to avoid overlapping with their high-frequency advertising time but also not to miss the best period for advertising in the industry.

In conclusion: The above is a free landing page analytics report about irs.gov. Doing a good job in advertising is a long-term accumulation process. In this process, we can use the bestlanding page software to find excellent landing page copy and landing page images for reference. At the same time, understand the competitors’ advertising strategies in advance, then adjust and test your advertising plans in a timely manner.

3. Related landing page report

If you want to check the relevant analysis of other landing page related to irs.gov, you can click the app name below to view related reports.